World Cup 2022 — Global Audience, Global Preferences

The World Cup routinely tops the list of most-watched sporting events globally every four years. It’s so big, that simply saying “The World Cup” is enough for the reader to know we’re talking about the football/soccer tournament, not the Rugby World Cup, or the Cricket World Cup. Mobile is also big. As a major media event, Digital Turbine surveyed viewers from around the globe to find patterns in viewership and how mobile has become an integral part of the World Cup viewership experience.

We’ll have more region and country breakdowns in the coming weeks, but let’s look at the global highlights first. One other thing: We’re calling it football in this article, because for most respondents, that’s how they refer to the game.

Download the Global Infographic

Who’s Watching?

The World Cup skews towards middle-aged for viewers, with the Millennial block of 25-34 taking up 40% globally, and older Xennial crossover group a full quarter. Sorry Millennials, yes, we’re middle-aged now. Gen Z is coming in close though with 22%.

Compared to our Super Bowl survey (which is North America only, but is still a worthwhile point of comparison), this is very different, where no single group made up more than 20% and it took Millennials and Xennials TOGETHER to bring up to 40%! Older Americans just like American Football more than older world citizens like football.

Once we converted incomes to USD, things were also very middle-heavy, which reinforces a widespread common belief that football is a sport that crosses socioeconomic lines. For advertisers, this means your perfect audience is almost certainly watching/reading about the World Cup.

Only 13% of World Cup viewers globally said they only watch football during World Cup matches, but nearly half (49%) watch every week or more frequently than that. Others fall into “highlight” or significant matches only.

Where Are They Watching?

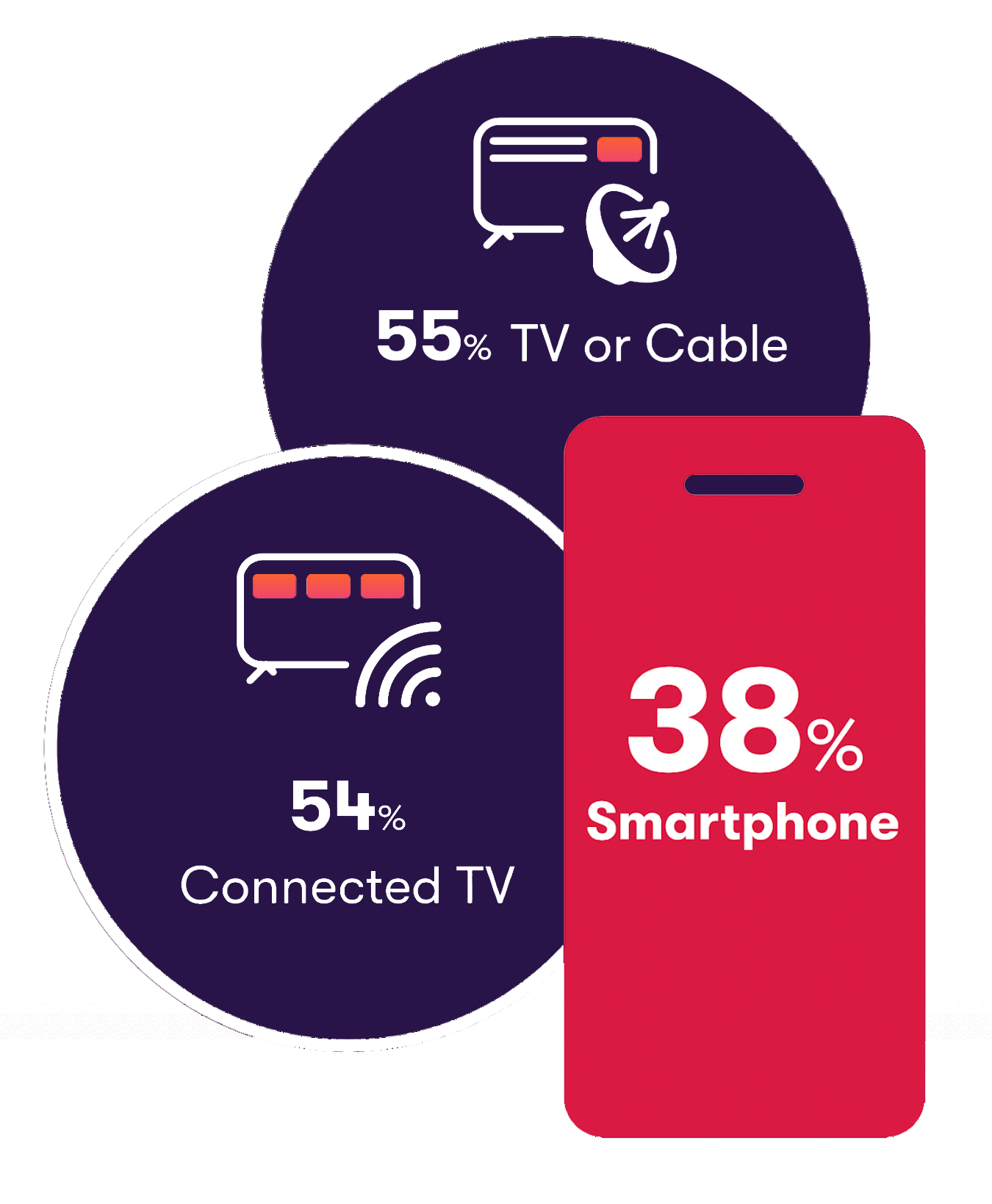

Much has been said about the habit of consumers worldwide to “second screen” TV with their phone, and the argument can be made that the TV is often the second screen! For the World Cup though, many consumers prefer to watch games on their TV, though the split between traditional broadcast or TV versus CTV apps is almost even.

A significant 38% said they would primarily be watching the games on their smartphones, and 74% of the total said keeping up with games on multiple devices is important. This is a stellar demonstration of how important smartphones are to consumers, and how critical it is that fans watch games live. If you’re at work, or running errands, or on public transport, what better way to watch is there?

When it came to how they viewed on a phone, or the apps consumers used on their phone while watching on TV, 67% used TV or streaming apps, 47% did so directly on the web, and 26% were using mobile-first platforms like DraftKings.

Reaching the Watchers

Brands have long looked at the World Cup and surrounding coverage and activities to reach consumers of all stripes (see demographics, above). When we asked, 54% of viewers are likely to look up an ad aired during the World Cup and watch it again. There was no distinction between where these ads were viewed in relation to channel (TV, CTV, mobile), just that they are ads shown during World Cup activities.

83% of World Cup viewers are likely to consider purchasing a product that they have seen advertised. That is a huge percentage of consumers placing trust in channels related to the World Cup vetting their ad partners. Talk about brand safety! Advertisers should be careful not to squander that opportunity.

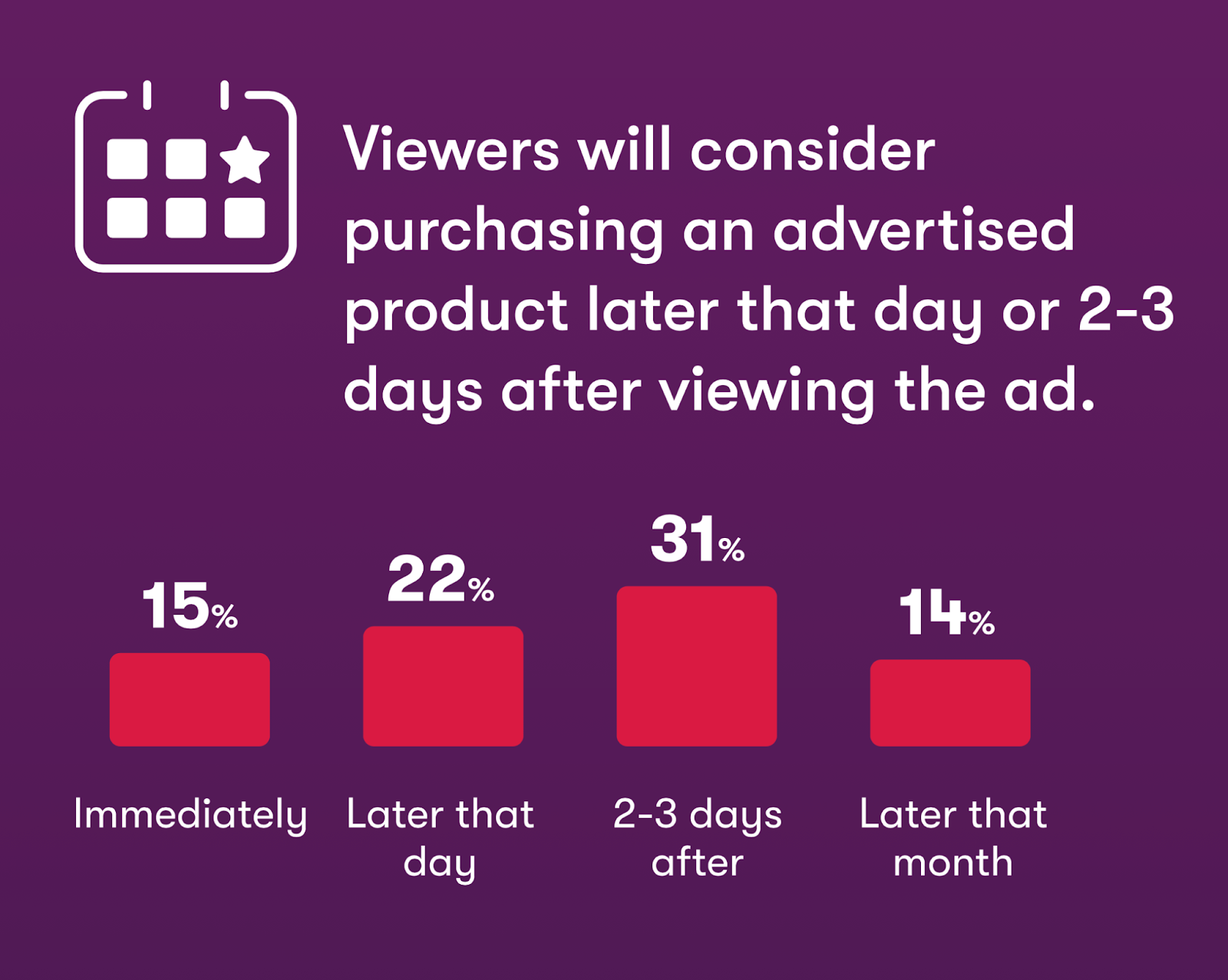

The best way to do that is with effective ads, and World Cup viewers globally want to see funny ads — nearly two-thirds — and with 31% considering purchasing within a couple of days, the opportunity for retargeting with incremental campaigns is something every media planner should be thinking about.

Since modern privacy laws and requirements have made device-based retargeting more challenging (especially in football-fanatic Europe, where GDPR is established and firmly understood), advertisers could use the contextual channels built around the World Cup such as football apps, football mobile games, and similar channels.

There’s a lot more detail to our picture of World Cup viewers this year, check out the full infographic below! Click on it to view/download the full size version, and keep an eye out for our regional breakdowns as the tournament itself nears this Fall!

Sign-Up

straight to your inbox.