The BRAG Blog: Product Innovation & Fitness App Growth

The BRAG Index, or Brand Relative App Growth Index, is a first of its kind report released by Digital Turbine and Apptopia in May 2022. The BRAG Index measures a brand’s app installs against its brand funnel (defined as consumer awareness and install intent) to find brands that had app growth that transcended its market presence.

The BRAG Blog gives you deeper insight into our findings. Read the full report here.

A Niche Category with Niche Apps

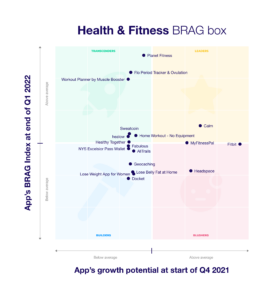

There’s no question that the pandemic changed Fitness. At-home orders kept people at home and people turned to at-home gyms and equipment. This also caused a boom for fitness apps like Peloton that brought instructor led training to the comfort of people’s homes. With people searching for workout options, many apps popped up to try and fill the void. With newer apps populating the space, Health & Fitness had the lowest overall awareness of any other category with Fitbit having the highest at 60% (it should be noted that Peloton was not one of the apps in our survey) and no other app even surpassing 41% awareness. Additionally, the category also had low average intent to install at 2.5%.

The combination of low awareness and install intent led to a category with the lowest overall Growth Potential. This resulted in a category with a lot of breakthrough apps and leadership positions that still are up for grabs as we come out of the pandemic.

What’s in the Box?

Health & Fitness tied with Finance for the most transcenders of any category with 7. Little known apps like Flo, Workout Planner, Home Workout and healow started our research period with awareness at 10% or less yet all ended the period in the top 8 in installs for the category.

Sweatcoin, who Apptopia recently profiled, combined fitness with the Web3 and token-based economics to garner 2 million installs as well despite a 7% overall awareness. On the other end, Fitbit, Calm, MyFitnessPal, Headspace, and Planet Fitness were the top 5 apps in terms of awareness and had differing levels of success based on how they approached the last 2 quarters.

Why Planet Fitness Can Brag and Why Fitbit Can Not

Planet Fitness’ Growth Potential was low not because of its awareness, which was the 4th highest at 37%, but because of a low install intent which was below the category average at 1.7%. Despite this, Planet Fitness easily had the most installs of ANY app in the category. The reason for this was a focus on turning their existing customers into app users.

Planet Fitness developed a mobile check-in feature and let its app serve as a keycard for existing members. As a result, all members who returned as pandemic restrictions eased downloaded their app.

Meanwhile, Fitbit had a 7% intent to install coupled with its 60% awareness measurement, giving it the largest growth potential in the category by a large margin. However, despite those lofty figures, Fitbit’s install volume was almost half of Planet Fitness. While Fitbit’s growth has always been dependent on device sales, their app growth has declined since June 2020, or shortly after their acquisition by Google. Some of this may be due to a loss in iOS market share as more people opt for an Apple Watch.

Keep Calm and Not Headspace

Another interesting contrast is between Calm and Headspace. Both entered the BRAG survey period as the top 2 apps in intent to install within the category. Much of this was likely driven by each app’s focus on corporate contracts, which built up awareness and install intent. However, despite the large growth potential only Calm was able to take advantage of it with total installs that were topped only by Planet Fitness.

Headspace meanwhile slumped to 14th in total installs out of all our apps surveyed, beaten out by apps with much smaller survey numbers. A driving factor for Calm’s success was its strategy to combine their corporate contracts with celebrity endorsers. The star power was enough to help keep Calm and establish themselves as a category leader. Headspace, meanwhile, was reliant on corporate HR to follow through on pushing the app to employees.

What’s Next?

With pandemic restrictions easing, people are wondering if the at-home fitness boom is coming to an end and people will start returning to gyms en masse. If that’s the case, look for more gyms to adopt a strategy similar to Planet Fitness and push their established members to their apps.

Stay tuned to the BRAG Blog to find out how the News category seems upside down in our BRAG Index.

Previous BRAG Blogs:

The BRAG Blog: A Streaming War Full of Surprises

How Shopping Apps Keep Up With Amazon

Which Apps Got UA BRAG-ging Rights. . . and How Did They Get Them?

Sign-Up

straight to your inbox.