The BRAG Index, or Brand Relative App Growth Index, is a first of its kind report released by Digital Turbine and Apptopia in May 2022. The BRAG Index measures a brand’s app installs against its brand funnel (defined as consumer awareness and install intent) to find brands that had app growth that transcended its market presence.

The BRAG Blog gives you deeper insight into our findings. Read the full report here.

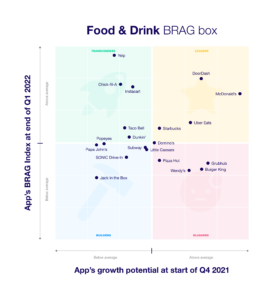

The Food & Drink Category Overview

One of the things that makes the BRAG Index work is that it measures consumer awareness and intent at the start of a period, in this case the beginning of Q4 2021, and then tracks installs for a set period following that (6 month or until the end of Q1 2022). Food & Drink was one category that was likely affected by fluctuations of the pandemic. In September, the Delta variant threatened another wave of stay at home orders. With this in mind, consumers had high awareness and intent of delivery apps, leading this category to the 2nd highest category average in each.

By March, however, pandemic restrictions had eased. And with it, people were embracing the opportunity to eat out. This led to a transcendent quarter from Yelp putting at the top of our BRAG rankings.

What’s In the Box?

With a lot of well known brands, consumer awareness had less variability with Food & Drink brands than other categories. While there were regional brands, like Popeye’s and Jack in the Box, with awareness in the 30% range, the majority of these brands were between 50-70% with McDonald’s topping the list at 74%.

With relatively similar awareness, this meant that install intent had a higher impact on an app’s brand funnel than any other category. QSR leaders like Burger King (11%), Grubhub (10%), Wendy’s (10%), and Little Caesars (9%) were well above the category average of 7% for install intent, but none of them managed to take advantage of that during the install period.

So What Happened?

As Apptopia pointed out in their recent blog about Chick-Fil-A, transcendent growth in this category often came down to smart marketing, promotion and partnerships. While Chick-Fil-A succeeded by partnering with sports teams, Taco Bell was a transcender thanks to the Taco Pass – a monthly subscription that came with free tacos. Dunkin’ also succeeded thanks to an integration with Apple Car Play that allowed app users to order from their cars and spike up growth and loyalty.

On the other end, even if most delivery services did well during our period, it was recently announced that Just Eat Takeaway (JET) was looking to sell Grubhub one year after they purchased the service. Sure enough, Grubhub ended up in our Blusher quadrant. Some of the results are likely attributed to not being able to keep up with innovations from DoorDash and UberEats which added grocery and convenience store delivery to their apps.

What’s Next?

Our next consumer survey is measuring awareness and install intent at the beginning of Q2. It will be interesting to see if BRAG Index wins by Chick-Fil-A, Taco Bell, and Dunkin’ translate into bigger brand funnels for our next period. We also decided to focus the Food & Drink category solely on Quick Service Restaurants (QSR) in our next BRAG Index, so some leaders in this report like Yelp and Instacart will not be compared to the more traditional restaurant brands.

Stay tuned to our BRAG Blog as we take a look at the Finance category later this week!

Sign-Up

straight to your inbox.